NATIONAL BEVERAGE CORP.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material |

NATIONAL BEVERAGE CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ | No fee required. |

☐ | ||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) | Title of each class of securities to which transaction applies: | ||

(2) | Aggregate number of securities to which transaction applies: | ||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) | Proposed maximum aggregate value of transaction: | ||

(5) | Total fee paid: | ||

☐ | Fee paid previously with preliminary materials. |

☐ | ||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: | ||

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

NATIONAL BEVERAGE CORP. |

| ||

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | |||

TIME: | |||

|  | |

| 2:00 p.m. (local time) | ||

DATE: | October | |

PLACE: | Hyatt Regency Orlando International Airport Hotel | |

9300 Jeff Fuqua Boulevard | ||

Orlando, FL 32827 | ||

At the Annual Meeting of Shareholders of National Beverage Corp. (the “Company”) and any adjournments or postponements thereof (the “Meeting”), the following proposals are on the agenda for action by the shareholders:

1. | To elect two directors to serve as Class |

| 2. | To transact such other business as may properly come before the Meeting. |

Only holders of record of common stock, par value $.01 per share, of the Company, at the close of business on August 20, 201219, 2013 are entitled to notice of, and to vote at, the Meeting.

A complete list of the shareholders entitled to vote at the Meeting will be available for examination by any shareholder for any proper purpose at the Meeting and during ordinary business hours for a period of ten days prior to the Meeting at the principal executive offices of the Company at 8100 SW Tenth Street, Suite 4000, Fort Lauderdale, Florida 33324.

All shareholders are cordially invited to attend the Meeting in person and those who plan to attend are requested to so indicate by marking the appropriate space on the accompanying proxy card. Shareholders whose shares are held in “street name” (the name of a broker, trust, bank or other nominee) should bring with them a legal proxy, a recent brokerage statement or other documentation of their beneficial ownership. Admittance to the Meeting will be limited to shareholders and our invited guests.

Whether or not you plan to attend the Meeting, please complete and returnthe proxy in the accompanying envelopeaddressed to the Company or vote electronically by using the Internet or by telephone, since a majority of the outstanding shares entitled to vote at the Meeting must be represented at the Meeting in order to transact business. Shareholders have the power to revoke any such proxy at any time before it is voted at the Meeting and the giving of such proxy will not affect your right to vote in person at the Meeting. Your vote is very important.

By Order of the Board of Directors, | |

| |

Nick A. Caporella | |

August | Chairman of the Board |

Fort Lauderdale, Florida | and Chief Executive Officer |

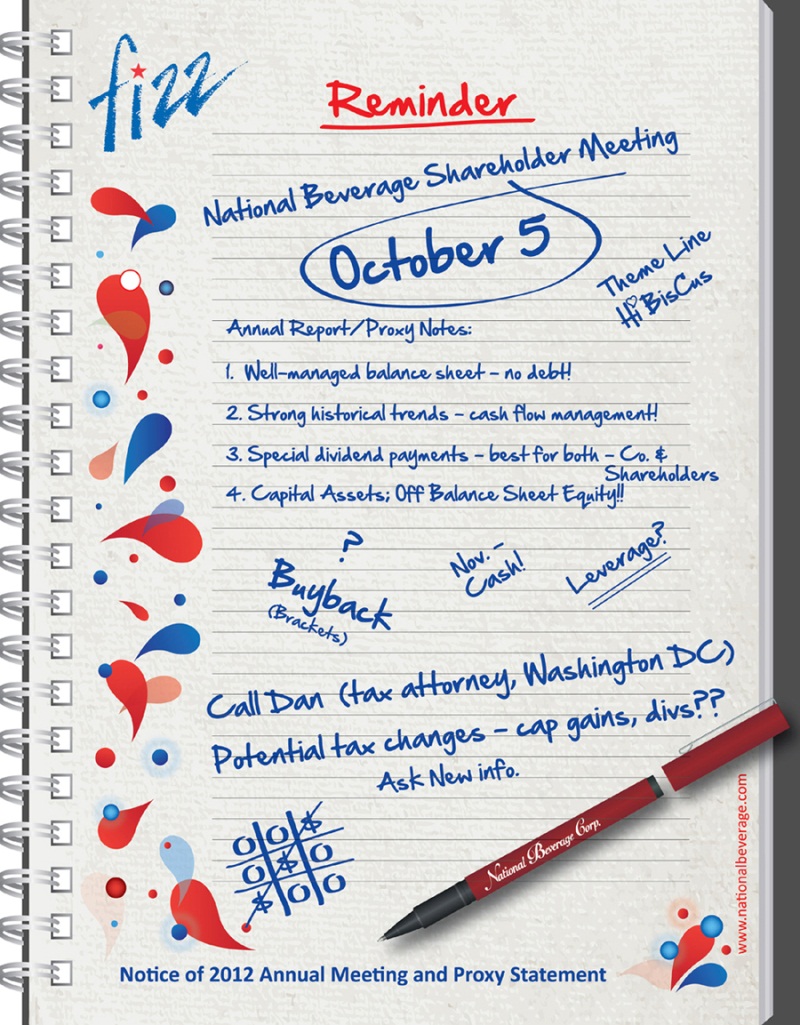

This Proxy Statement is furnished to shareholders of National Beverage Corp., a Delaware corporation (the “Company”, “NBC”, “we”, “us” or “NBC”“our”), in connection with the solicitation, by order of the Board of Directors of the Company (the “Board of Directors” or the “Board”), of proxies to be voted at the Annual Meeting of Shareholders of the Company to be held at the Hyatt Regency Orlando International Airport, 9300 Jeff Fuqua Boulevard, Orlando, Florida 32827 on October 5, 2012,11, 2013, at 2:00 p.m., local time, or any adjournment or postponement thereof (the “Meeting”). The accompanying proxy is being solicited on behalf of the Board of Directors. The mailing address of the principal executive offices of the Company is P.O. Box 16720, Fort Lauderdale, Florida 33318. The approximate date on which this Proxy Statement and the accompanying form of proxy were first sent to shareholders is September 4, 2012.

Only holders of record of common stock, par value $.01 per share, of the Company (the “Common Stock”) at the close of business on August 20, 201219, 2013 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. Each holder of Common Stock is entitled to one vote for each share held at the close of business on the Record Date.

A shareholder who gives a proxy may revoke it at any time before it is exercised by sending a written notice to the Corporate Secretary, at the mailing address set forth above, by returning a later dated signed proxy or by attending the Meeting and voting in person. Unless the proxy is revoked, the shares represented thereby will be voted as specified at the Meeting.

The Annual Report of the Company for the fiscal year ended April 28, 201227, 2013 (the “Annual Report”) is being mailed with this Proxy Statement to all holders of record of Common Stock. Additional copies of the Annual Report will be furnished to any shareholder upon request.

Principal Shareholders

As of the Record Date, 46,298,55546,330,415 shares of Common Stock were outstanding and, as of such date, the only persons known by the Company to beneficially own more than 5% of the outstanding Common Stock were the following:

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

Nick A. Caporella 8100 SW Tenth Street Fort Lauderdale, Florida 33324 | 34,244,5851 | 74.0% |

IBS Partners Ltd. 1127 Eldridge Parkway Suite 300-0137 Houston, Texas 77077 | 33,302,246 | 71.9% |

Name and Address Of Beneficial Owner Amount and Nature of Beneficial Ownership Percent of Class Nick A. Caporella 8100 SW Tenth Street Fort Lauderdale, Florida 33324 34,244,5851 73.9% IBS Partners Ltd. 1127 Eldridge Parkway Suite 300-0137 Houston, Texas 77077 33,302,246 71.9%

____________

1 | Includes 33,302,246 shares owned by IBS Partners Ltd. (“IBS”). IBS is a Texas limited partnership whose sole general partner is IBS Management Partners, Inc., a Texas corporation. IBS Management Partners, Inc. is owned by Mr. Nick A. Caporella. By virtue of Rule 13d-3 promulgated under the Exchange Act, Mr. Caporella would be deemed to beneficially own the shares of Common Stock owned by IBS. Also includes 27,056 shares held by the wife of Mr. Caporella as to which Mr. Caporella disclaims beneficial ownership. |

Directors and Executive Officers

The table below reflects, as of the Record Date, the number of shares of Common Stock beneficially owned by the directors and each of the executive officers named (the “Executive Officers”) in the Summary Compensation Table that follows and the number of shares of Common Stock beneficially owned by all directors and Executive Officers as a group:

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||||||

Nick A. Caporella | 34,244,5851 | 73.9% | |||||||

Joseph G. Caporella |

| * | |||||||

Cecil D. Conlee | 31,9203 | * | |||||||

Samuel C. Hathorn, Jr. | 84,7874 | * | |||||||

Stanley M. Sheridan | | * | |||||||

George R. Bracken | 136,1386 | * | |||||||

Dean A. McCoy | | * | |||||||

Gregory I. Roberts | — | * | |||||||

All Executive Officers and directors as a group | 35,019,6568 | 75.6% | |||||||

* | Less than 1%. |

1 | Includes 33,302,246 shares held by IBS. |

2 | Includes |

3 | Includes |

| 4 | Includes |

| 5 | Includes |

6 | Includes |

7 | Includes |

8 | Includes |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) requires the Company’s Executive Officers, directors and persons who own more than ten percent (10%) of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the United States Securities and Exchange Commission (the “SEC” or “Commission”). Executive Officers, directors and greater than ten percent (10%) beneficial owners are required by regulation of the Commission to furnish the Company with copies of all Section 16(a) forms so filed.

To our knowledge, based solely on review of Form 3, 4 and 5 reports and amendments thereto and certain representations furnished to the Company, during the fiscal year ended April 28, 201227, 2013 (“Fiscal 2012”2013”), the Company’s Executive Officers, directors and greater than ten percent (10%) beneficial owners complied with all applicable filing requirements.

The Company is managed under the direction of the Board of Directors. The Board meets to review significant developments affecting us and to act on matters requiring Board approval.

Current committee membership is shown in the table below.

Name | Board | Audit | Compensation and Stock Option | Nominating | Strategic Planning | |

Nick A. Caporella | Chairman | — | — | Chairman | Chairman | |

Joseph G. Caporella | Member | — | — | — | — | |

Cecil D. Conlee | Member | Member | Chairman | — | Member | |

Samuel C. Hathorn, Jr. | Member | Chairman | Deputy Chairman | Deputy Chairman | Member | |

Stanley M. Sheridan | Member | Deputy Chairman | Member | Member | — | |

The Board of Directors held foureight meetings during Fiscal 2012.2013. The Board of Directors has standing Audit, Compensation and Stock Option, Nominating and Strategic Planning committees.

The Audit Committee is currently comprised of fourthree independent members – Messrs. Samuel C. Hathorn, Jr. (Chairman), Stanley M. Sheridan (Deputy Chairman), and Cecil D. Conlee, andConlee. Prior to his resignation on October 5, 2012 the Audit Committee included Joseph P. Klock, Jr. The Audit Committee held four meetings during Fiscal 2012.2013. The principal functions of the Audit Committee are to appoint the independent auditors of the Company and to review with the independent auditors and the Company’s internal audit department the scope and results of audits, the internal accounting controls of the Company, audit practices and the professional services furnished by the independent auditors. The Company’s Board of Directors has determined that Messrs. Conlee, Hathorn and Sheridan satisfy the requirements for an audit committee financial expert under the rules and regulations of the Commission. The Board of Directors has concludedCommission and that the memberseach member of the Audit Committee areis “independent” as defined in the NASDAQ listing standards. The Audit Committee has a charter as required under the NASDAQ listing standards. TheCommittee’s charter is available on our website at www.nationalbeverage.com under “Theunder“The Business – Investors – Corporate Governance.”

The current members of the Company’s Compensation and Stock Option Committee are Messrs. Cecil D. Conlee (Chairman), Joseph G. Caporella (Deputy Chairman), Samuel C. Hathorn, Jr., (Deputy Chairman) and Joseph P. Klock, Jr.Stanley M. Sheridan. During Fiscal 2012,2013, the Compensation and Stock Option Committee held two meetings. The principal functions of the Compensation and Stock Option Committee are to consider, review and approve all compensation arrangements, including base salary, annual incentive awards and stock option grants, for officers and employees of the Company and to administer the Company’s employee benefit programs. The Compensation and Stock Option Committee does not have a charter.

The current members of the Company’s Nominating Committee are Messrs. Nick A. Caporella (Chairman), Joseph P. Klock, Jr. (Deputy Chairman), Samuel C. Hathorn, Jr. (Deputy Chairman) and Stanley M. Sheridan. During Fiscal 2012,2013, the Nominating Committee held one meeting.two meetings. The Nominating Committee recommends to the Board of Directors candidates for election to the Board. The Nominating Committee considers possible candidates from any source, including shareholders, for nominees for directors. In evaluating the qualifications of nominees, the Nominating Committee considers a variety of factors, such as education, work experience, knowledge of the Company and the beverage industry, membership on the Boardboard of Directorsdirectors of other corporations, civic involvement and diversity. The Nominating Committee does not have a specific policy with respect to diversity on the Board of Directors. Recommendations for director candidates, which shall include written materials with respect to the potential candidate, should be sent to Corporate Secretary, National Beverage Corp., P.O. Box 16720, Fort Lauderdale, Florida 33318. All shareholder nominees for director will be considered by the Nominating Committee in the same manner as any other nominee. All recommendations should be accompanied by a complete statement of such person’s qualifications (including education, work experience, knowledge of the Company’s industry, membership on the Boardboard of Directorsdirectors of another corporation and civic activity) and an indication of the person’s willingness to serve. The Nominating Committee does not have a charter.

The current members of the Company’s Strategic Planning Committee are Messrs. Nick A. Caporella (Chairman), Cecil D. Conlee and Samuel C. Hathorn, Jr. The Strategic Planning Committee did not meet separately during Fiscal 20122013 as the election of Mr. Conlee to the Board in 2009 allowed the advice and consultation of the committee members to be obtained during the regular meetings of the Board.

In addition to the above standing committees, the Board of Directors from time to time has appointed certain ad hoc committees. During Fiscal 2012,2013, such committees included the Special Committee, formed to evaluate capital deployment options, the Litigation Advisory Committee, formed to assist Company management with certain legal matters and the Strategic Transaction Committee, formed to evaluate strategic business opportunities.

Each director attended all of the meetings of the Board and standing committees on which he serves. We have no formal policy regarding directors' attendance at annual meetings of shareholders but all directors have attended past annual shareholder meetings and we anticipate that all directors will attend the 20122013 Meeting.

Mr. Nick A. Caporella currently beneficially owns approximately 74.0%73.9% of the Company’s outstanding Common Stock. As a result, the Company is a “controlled company” within the meaning of the NASDAQ listing standards and is therefore not currently required to have independent directors comprise a majority of its Board of Directors or to have independent directors comprise its Compensation and Stock Option Committee or its Nominating Committee. However, during Fiscal 2012, independent directors comprisedcomprise the majority of both the Nominating Committee and the Compensation and Stock Option Committee.Committee is comprised of only independent directors. Messrs. Cecil D. Conlee, Samuel C. Hathorn, Jr., Joseph P. Klock, Jr. and Stanley M. Sheridan qualify as independent directors under the NASDAQ listing standards.

In compliance with NASDAQ listing standards, the independent directors have regularly scheduled meetings at which only independent directors are present.

QUORUM AND VOTINGVOTING PROCEDURE

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Meeting is necessary to constitute a quorum. Votes cast by proxy or in person at the Meeting will be tabulated by the inspectors of election appointed for the Meeting and will be counted in determining whether or not a quorum is present. A proxy submitted by a shareholder may indicate that all or a portion of the shares represented by such proxy are not being voted by such shareholder with respect to a particular matter (“non-voted shares”). This could occur, for example, when a broker is not permitted to vote shares held in “street name” on certain matters in the absence of instructions from the beneficial owner of the shares. Non-voted shares with respect to a particular matter will not be considered shares present and entitled to vote on such matter, although such shares may be considered present and entitled to vote for other purposes and will be counted for purposes of determining the presence of a quorum. Shares voting to abstain as to a particular matter and directions to “withhold authority” to vote for directors will not be considered non-voted shares and will be considered present and entitled to vote with respect to such matter. Non-voted shares and abstentions will have no effect on the matters brought to a vote at the Meeting. As a result of Mr. Nick A. Caporella’s beneficial ownership of approximately 74.0%73.9% of the outstanding shares of Common Stock of the Company, the election of two Class III directors will be approved by vote of shareholders at the Meeting.

MATTER TO BE CONSIDERED ATANNUAL MEETING

Currently, the Board is comprised of sixfive directors elected in three classes (the “Classes”). During Fiscal 2013, the Board of Directors decreased the number of directors of the Board from six to five following the resignation of Joseph P. Klock, Jr. on October 5, 2012. Directors in each class hold office for three-year terms and the terms of the Classes are staggered so that the term of one Class terminates each year. The terms of the current Class III directors expire at the 20122013 Meeting.

The Board of Directors has nominated Joseph G. CaporellaCecil D. Conlee and Samuel C. Hathorn, Jr.Stanley M. Sheridan for election as directors in Class I,II, with a term of office of three years expiring at the Annual Meeting of Shareholders to be held in 2015. 2016 and when their respective successors have been duly elected and qualified. In order to be elected as a director, a nominee must receive a plurality of affirmative votes cast by the shares present or represented at a duly convened meeting. Shareholders have no right to vote cumulatively.

THEBOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE NOMINEES FOR THE CLASS III DIRECTORS.

Nominees for Director

CLASS I

| Name | Age | Principal Occupation or Employment | Director Since | Term Expires |

| Joseph G. Caporella | 52 | President of National Beverage Corp. | 1987 | 2012 |

| Samuel C. Hathorn, Jr. | 69 | Retired President and Chief Executive Officer of Trendmaker Homes, Inc., a subsidiary of Weyerhaeuser Company. | 1997 | 2012 |

Name Age Principal Occupation or Employment Director Since Term Expires Cecil D. Conlee 77 Founding Partner of CGR Advisors. Former Director, Oxford Industries, Inc. 2009 2013 Stanley M. Sheridan 70 Retired President of Faygo Beverages, Inc., a wholly- owned subsidiary of National Beverage Corp. 2009 2013

Directors Whose Term of Office Will Continue After the Annual Meeting

CLASS II

Name | Age | Principal Occupation or Employment | Director Since | Term Expires |

| Cecil D. Conlee | 76 | Founding Partner of CGR Advisors. Former Director, Oxford Industries, Inc. | 2009 | 2013 |

| Stanley M. Sheridan | 69 | Retired President of Faygo Beverages, Inc., a wholly owned subsidiary of National Beverage Corp. | 2009 | 2013 |

Name | Age | Principal Occupation or Employment | Director Since | Term Expires |

| Nick A. Caporella | 76 | Chairman of the Board and Chief Executive Officer of National Beverage Corp. | 1985 | 2014 |

| Joseph P. Klock, Jr. | 63 | Partner of Rasco, Klock, Reininger, Perez, Esquenazi, Vigil & Nieto, a law firm in Miami, FL. | 1987 | 2014 |

Name Age Principal Occupation or Employment Director Since Term Expires Nick A. Caporella 77 Chairman of the Board and Chief Executive Officer of National Beverage Corp. 1985 2014

CLASS I

Name Age Principal Occupation or Employment Director Since Term Expires Joseph G. Caporella 53 President of National Beverage Corp. 1987 2015 Samuel C. Hathorn, Jr. 70 Retired President and Chief Executive Officer of Trendmaker Homes, Inc., a subsidiary of Weyerhaeuser Company. 1997 2015

Additional information regarding the nominees for election as director and the continuing directors of the Company, including a description of the specific experience, qualifications, attributes and skills that led the Board of Directors to conclude that each individual should serve as a director, is set forth below:

Nominees

Cecil D. Conlee is a partner of CGR Advisors, a real estate investment advisory firm located in Atlanta, Georgia that he founded in 1990. He served as a director of Oxford Industries, Inc., an international apparel design, sourcing and marketing company from 1985 until June 2011, and was a member of the Executive Committee and Chairman of the Audit Committee. He also served as a director of Central Parking Corp. from 1996 to 2006. Mr. Conlee has been a member on the Company’s Strategic Planning Committee since 1995 and was a lead director of Burnup and& Sims Inc. (a former affiliate of the Company) for more than 20 years. As a result, he gained unique knowledge and experience during the formative years of the Company. In addition, Mr. Conlee holds an MBA from Harvard University and was a Trustee of Vanderbilt University. Mr. Conlee’s education, business acumen, leadership skills, civic involvement and his knowledge and experience related to our Company qualify him to serve on our Board.

Stanley M. Sheridan was employed by Faygo Beverages, Inc., a wholly ownedwholly-owned subsidiary of National Beverage Corp., from 1974 until his retirement in 2004. He joined Faygo Beverages, Inc. as Chief Financial Officer in 1974 and was promoted to President in May 1987 when Faygo Beverages, Inc. was acquired by National Beverage Corp. He holds an MBA in Accounting and has served on the boards of various private companies and charitable organizations. Mr. Sheridan’s retirement in 2004 and his absence from Faygo Beverages, Inc. qualify him as an independent director for the Company. Mr. Sheridan’s 30 years of experience in the beverage industry and his professional management expertise as a chief executive in the soft drink industry make him extremely familiar with our business. These qualifications and his financial and accounting expertise qualify him to serve on our Board.

Continuing Directors

Nick A. Caporella has served as Chairman of Contentsthe Board and Chief Executive Officer of the Company since the Company was founded in 1985. He also served as President until September 2002. Since January 1992, Mr. Caporella’s services have been provided to the Company through a management company, Corporate Management Advisors, Inc. (“CMA”), an entity which he owns. (See “Management Services Agreement – Compensation” and “Certain Relationships and Related Party Transactions”.) Mr. Caporella previously served as President and Chief Executive Officer (since 1976) and Chairman of the Board (since 1979) of Burnup & Sims Inc. until March 1994. Throughout his more than 50-year business career, he has founded or managed as the Chief Executive Officer successful companies and has served as a public company Chairman, Chief Executive Officer or President since 1976. Mr. Caporella has achieved many awards as a businessman, including induction into the Institute of American Entrepreneurs and receipt of the Horatio Alger Award. He is involved in many research projects which endeavor to advance the cure of children’s cancer and currently serves on the Professional Advisory Board of St. Jude Children’s Hospital. The Company was founded as a result of Mr. Caporella’s vision and entrepreneurial spirit and his extraordinary career, entrepreneurial spirit, business acumen and civic leadership qualify him to serve on the Board.

Joseph G. Caporella has served as President of the Company since September 2002 and, prior to that date, served as Executive Vice President since January 1991. He is the son of Mr. Nick A. Caporella. Since joining the Company in 1988, he has been involved in all aspects of the Company’s operations, including procurement, supply chain management, distribution and sales leadership. Mr. Caporella’s more than 25 years of experience in the beverage industry coupled with his extensive knowledge of the day-to-day business operations of the Company qualify him to serve on our Board.

Samuel C. Hathorn, Jr. was employed by Trendmaker Homes, Inc. from 1981 until his retirement in September 2007. He served as President since 1983 and was appointed Chief Executive Officer in January 2007. Trendmaker Homes, Inc. is a Houston, Texas-based homebuilding and land development subsidiary of Weyerhaeuser Company. Mr. Hathorn has also held senior executive and financial positions with several public corporations and served as a director of Burnup & Sims Inc. from 1981 until 1997 and of Hartman Commercial Properties REIT, a publicly-traded real estate investment trust, from 2000 to 2005. Mr. Hathorn first served on the Company’s Board of Directors from its inception in 1985 to September 1993 while also serving as a Burnup & Sims director and representative during the Company’s formative years. He returned to our Board in June 1997 and has served as a director since that time. Mr. Hathorn’s extensive expertise as a seasoned financial executive, his professional business acumen and his intimate knowledge of our business qualify him to serve on our Board.

The Board of Directors does not have a policy addressing whether the same person should serve as both the Chief Executive Officer and Chairman of the Board or if the roles should be separate. Our Boardseparate but believes that it should have the flexibility to make its determination based upon what it considers to be the appropriate leadership structure for the Company at the time. OurThe Board further believes that having a single person serving as both Chief Executive Officer and Chairman of the Board, coupled with our use of individual chairmen for each of our Board Committees, provides the best form of leadership for our Company, and accordinglyCompany. Accordingly, the Board has not deemed it necessary or appropriate to create the position of lead independent director, in that each Committee Chairman functions in the capacity akin to that of a lead director. Combining the Chairman and Chief Executive Officer roles fosters clear accountability, effective decision-making, alignment of our corporate strategies and has served the Company well for many years. As our Chief Executive Officer, Mr. Nick A. Caporella is and has been responsible for overseeing the operations of the Company and implementing the Company’s corporate strategies. The Board believes that the breadth of Mr. Caporella’s business experience, professional and successful track record in all of his undertakings in the Company, along with his position as founder and controlling shareholder of the Company, make him uniquely qualified to continue to preside over the entire Board, lead its strategies and discussions and set its agendas.

Board’s RolBOARD’S ROLE IN RISK OVERSIGHTe in Risk Oversight

While management is primarily responsible for the day-to-day assessment and risk management programs, ourthe Board of Directors is responsible for oversight of enterprise-wide exposures, including strategic, operational, financial, legal and regulatory risks. The Board performs its oversight function both directly and indirectly through Board committees that are chaired by professionals with varied and extensive business experience. The Audit Committee assists the Board in evaluating financial risks and risks related to the Company’s financial reporting, internal controls and compliance with legal and regulatory requirements. The Compensation and Stock Option Committee assists the Board in evaluating risks associated with leadership assessment, management succession planning and our compensation philosophy and programs. In addition to committee reports, the Board receives regular presentations from senior management and senior department heads, which include presentations regarding the annual operating plan as well as long-term operational and strategic matters.

Compensation Discussion and Analysis

The following discussion and analysis is intended to provide an understanding of the Company’s compensation philosophy and policies and the actual compensation earned by each of our Executive Officers. It should be noted that neither Mr. Nick A. Caporella nor Mr. Bracken receives cash compensation from the Company. The services of both are provided to the Company by CMA and their cash compensation is based solely on and included within the one percent annual management fee paid to CMA. (See “Management Services Agreement – Compensation” and “Certain Relationships and Related Party Transactions”.)

At the 2011 Annual Meeting, 99.9% of the shares voted by our shareholders (99.4%, excluding shares voted by IBS) were voted to approve, on an advisory basis, the compensation of our Executive Officers. We believe this vote supports our view that the Company’s compensation decisions and compensation philosophy and policy discussed below appropriately align the interests of our Executive Officers with the short and long termlong-term goals of the Company. Also based on the advisory vote of our shareholders at the 2011 Annual Meeting, the Board determined that the Company will hold shareholder advisory votes on executive compensation every three years. The next shareholder advisory vote on executive compensation is scheduled to take place at the Annual Meeting of Shareholders to be held in 2014.

The objectives of the Company’s compensation program are to (1) attract, motivate, develop and retain top quality executives who will increase long-term shareholder value and (2) deliver competitive total compensation packages based upon the achievement of both Company and individual performance goals. The Company expects its executives to balance the risks and related opportunities inherent in our industry and in the performance of his or her duties, and to adhere to the Company’s philosophy and business principles in order to participate in any upside opportunity once actual performance is measured.

To achieve the above goals, the Compensation and Stock Option Committee has set forth a compensation program for its Executive Officers that includes the following elements:

Base salary;

Annual cash bonuses;

• | Share-based compensation; and | |

• | Retirement, health and other benefits. |

In order to maintain a competitive compensation program for its Executive Officers, the Compensation and Stock Option Committee, on an annual basis, performs the following:basis: (a) reviews compensation practices to assure fairness, relevance, support of the strategic goals of the Company and contribution of the executive to the creation of long-term shareholder value, (b) considers the relevant mix of compensation components and (c) implements a compensation plan that reasonably allocates a portion of each executive’s total compensation to incentives and other forms of longer-term compensation linked to Company and individual performance and the creation of shareholder value.

Factors Considered In Determining Compensation

The Compensation and Stock Option Committee reviews executive compensation levels for its Executive Officers on a semi-annual basis to ensure that they remain competitive within the beverage industry. The overall value of the compensation package for an Executive Officer is determined by the Compensation and Stock Option Committee in consultation with the Chief Executive Officer, other key officers and the Board. The factors considered by the Compensation and Stock Option Committee include those related to both the overall performance of the Company and the individual performance of the Executive Officer. Consideration is also given to comparable compensation data for individuals holding similarly responsible positions at other and peer group companies in determining appropriate compensation levels.

With respect to long-term incentive compensation to be awarded to Executive Officers, the Company maintains three equity basedequity-based plans: (a) the 1991 Omnibus Incentive Plan, (b) the Special Stock Option Plan and (c) the Key Employee Equity Partnership Program (each plan is discussed in more detail below).

The timing, amount and form of awards under these plans for each of the Executive Officers is made at the discretion of the Compensation and Stock Option Committee based on recommendations of the Chief Executive Officer. Any such awards are granted only upon the written approval of the Compensation and Stock Option Committee. No stock basedstock-based awards or other equity rights have been granted to Mr. Nick A. Caporella since the Company’s inception.

Base Salary

Base salary is used to attract and retain Executive Officers and is determined using comparisons with industry competitors and other relevant factors including the seniority of the individual, the functional role of the position, the level of the individual’s responsibility and the ability to replace the individual. Salaries for the Executive Officers are reviewed by the Compensation and Stock Option Committee, the Chief Executive Officer and the Board on a semi-annual basis. Changes to base salaries, if any, are affected primarily by individual performance.

Annual Cash Bonuses

Annual cash bonuses are intended to be a significant component of an Executive Officer’s compensation package. The amount of annual bonus compensation to be awarded to the Executive Officers, if any, is determined by the Compensation and Stock Option Committee, upon recommendation by the Chief Executive Officer. While the Chief Executive Officer and the Compensation and Stock Option Committee consider the Company’s overall performance and each individual’s performance when determining the amount of bonus to award, there is no predefined written plan, acknowledged by the recipient, with respect to performance measures that obligates the Company to pay an annual cash bonus and the Compensation and Stock Option Committee retains absolute discretion to award bonuses and to determine the amount of such bonuses.

Share-Based Compensation (Long-Term Incentive Programs)

Share-based long-term incentive compensation awarded to Executive Officers is provided through the issuance of stock options. The primary purpose of stock options is to provide Executive Officers and other employees with a personal and financial interest in the Company’s success through stock ownership, thereby aligning the interests of such persons with those of our shareholders. The Compensation and Stock Option Committee believes that the value of stock options will reflect the Company’s financial performance over the long-term. Because the Company’s stock option programs require vesting periods before options may be exercised and an exercise price based on either the fair market value as of the date of grant or the amount of Common Stock held, the value of stock options and stock ownership increases when the market value of the Company’s common shares increases over time.

Share-based awards made under the Company’s 1991 Omnibus Incentive Plan (the “Omnibus Plan”) typically consist of options to purchase Common Stock which vest over five years and have a term of ten years. Certain key executives of the Company also receive grants from time to time under the Company’s Special Stock Option Plan (the “Special Option Plan”). The vesting schedule and exercise price of these options are tied to the executive’s ownership levels of Common Stock. Generally, the terms of the Special Option Plan allows for the reduction in exercise price upon each vesting date of the option. The vesting schedule and exercise price reduction of such options may be accelerated at the discretion of the Compensation and Stock Option Committee. While the Compensation and Stock Option Committee considers the Company’s overall financial performance during the respective vesting periods, there is no predefined written plan with respect to financial measures that obligate the Company to such acceleration, and the Compensation and Stock Option Committee has not elected to accelerate the vesting or price reduction of any options held by Executive Officers during the past three fiscal years. The Company issues share-based awards with long-term vesting schedules designed to increase the level of the executive’s stock ownership; continued long-term employment; adherence to the Company’s principles and philosophy and the long-term creation of value for shareholders while inducing corporate compatibility within the management team.

In addition, share-based compensation is awarded under the Company’s Key Employee Equity Partnership Program (the “KEEP Program”). The KEEP Program is designed to positively align interests between the Company’s executives and its shareholders beyond traditional option programs while, at the same time, intending to stimulate and reward management in “partnering-up” with the Company to create shareholder value. The KEEP Program provides for the granting of stock options to key employees, officers and directors of the Company who invest their personal funds in Common Stock. Participants who purchase shares of Common Stock in the open market receive grants of stock options equal to 50% of the number of shares purchased up to a maximum of 6,000 shares purchased in any two-year period. Options under the KEEP Program are automatically forfeited in case of the sale of shares originally acquired by the participant. The options are granted at an initial exercise price of 60% of the purchase price paid for the shares acquired and reduce to the par value of Common Stock at the end of the six-year vesting period.

The Company’s long-term incentive programs are generally intended to provide rewards to executives only if value is created for shareholders over time and the executive continues in the employ of the Company. The Compensation and Stock Option Committee believes that employees should have sufficient holdings of the Company’s Common Stock so that their decisions will appropriately foster sound judgment in the exercise of their duties. The Compensation and Stock Option Committee reviews with the Chief Executive Officer the recommended individual awards and evaluates the scope of responsibility, strategic and operational goals and individual contributions in making final awards under the Omnibus Incentive Plan, the Special Option Plan and determining participants in the KEEP Program.

Options issued pursuant to the Special Option Plan and the KEEP Program after December 31, 2004 are considered deferred compensation arrangements under Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, option recipients must make a written election to exercise option grants on specified future dates to avoid being subject to additional income taxes, interest and withholding. The election is irrevocable, but may be subject to acceleration upon proper termination of employment, disability or in certain other limited circumstances, all at the discretion of the Board of Directors. All Executive Officers holding options granted under these plans have made such an election.

With respect to share-based compensation, the Company recognizes stock compensation expense in accordance with FASB Accounting Standards Codification Topic 718 which requires public companies to measure the cost of employee services received in exchange for an award of equity instruments based on the grant date fair value of the award. The Company uses the Black-Scholes option-pricing model to determine the grant date fair value.

The Company ensures that stock option awards approved by the Compensation and Stock Option Committee will be granted subsequent to any planned release of material non-public information. The Company has not engaged in the backdating, cancellation or re-pricing of stock options awarded to its Executive Officers.

Retirement, Health and Other Benefits

The Company provides retirement, health and other benefits as an additional incentive to retain employees. The Company maintains a defined contribution 401(k) plan that allows employees to make plan contributions on a pre-tax basis and currently contributes an additional profit sharing contribution on behalf of each employee. Profit sharing contributions are allocated to all employees who meet certain minimum service requirements, based on a percentage of total compensation, which amount is subject to change from year to year. Although Executive Officers are eligible to participate in the 401(k) plan, they have been prevented from participating at the same level as non-executives, due to the rules under Section 401(a)(17) of the Code which dictate the application of an annual limitation on contributions.

We currently make available to our Executive Officers and all employees a comprehensive health, dental, life and disability insurance program. The health care insurance program offers a variety of coverage options, which may be selected at the employee’s discretion. The Company currently provides a basic term life insurance policy to all employees and makes additional coverage available at the employee’s expense and discretion.

The Company does not provide any additional perquisites to Executive Officers, other than a car allowance, which is included in the Summary Compensation Table below. The Company values this car allowance benefit based upon the actual cost to the Company. The total of all perquisites to any Executive Officer did not equal or exceed $10,000 for Fiscal 2012.

Employment, Change in Control and Severance Agreements

The Company does not typically enter into, and does not currently have, any formal employment, change in control, severance or other similar agreements with any Executive Officer. The Company’s stock option plans, however, provide that unvested options held by all employees will fully vest if a change of control (as defined in the plans) occurs or if options of an equivalent value are not provided in the event the Company is not the surviving entity of a merger or consolidation. Based on the difference between the closing stock price of the Company’s Common Stock on April 28, 201227, 2013 and the option exercise prices on that date, the values of unvested options held by our Executive Officers were: Joseph G. Caporella - $268,877;$222,205; George R. Bracken - $39,732;$35,597; and Dean A. McCoy - $44,574.

The Company may also, from time to time, pay severance to an employee, including an Executive Officer, based on, among other things, years of service, functional role or position and level of the individual’s responsibility and reasons for terminating his or her services. The Company believes in trust, loyalty and commitment from both the Company and the Executive Officers and that employment agreements are not necessary to achieve its goals and meet the needs of the Executive Officers. The Company believes that the fact that most of the executives of the Company have been with the Company for a long period of time supports this belief.

REPORT OF THE COMPENSATIONCOMPENSATION AND STOCK OPTION COMMITTEE

The Compensation and Stock Option Committee has reviewed and discussed the foregoing Compensation Discussion and Analysis, required by Item 402(b) of Regulation S-K, with management of the Company. Based on this review and discussion, we recommendrecommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement for the Company's 20122013 Annual Meeting of Shareholders.

THE COMPENSATION AND STOCK OPTION COMMITTEE

Cecil D. Conlee (Chairman)

Samuel C. Hathorn, Jr.

CMA, pursuant to a management agreement, provides the services of and compensates the Company’s Chief Executive Officer, Chief Financial Officer and all senior and other corporate personnel, who provide management, administrative and creative functions to the Company. Although management fees paid to CMA have been disclosed in “Certain Relationships and Related Party Transactions” since the inception of the management agreement in 1992, during 2009, the Commission requested that we modify the presentation of amounts paid to Mr. Nick A. Caporella and Mr. BrackenBracken. In a comment letter dated February 9, 2009, the Commission staff requested that, due to Mr. Caporella’s 100% ownership of CMA, the entire management fee paid to CMA be reflected as compensation to Mr. Caporella in the body of the Summary Compensation Table below.Table. As a result, we agreed (for reporting purposes) to include the total management fee paid by the Company to CMA under the caption “All Other Compensation” with respect to Mr. Nick A. Caporella’s compensationCaporella in the Summary Compensation Table. While weWe believe this method of reporting constitutes a conservative and probably misleading approach that could have the reader construe that these amounts are paid by the Company and/or CMA directly to him due to Mr. Caporella’shis ownership of CMA. These amounts paid by the Company to CMA, these amountsas reflected in the Summary Compensation Table, should not be construedinterpreted as the actual amount of compensation paid to him by either the Company or CMA.CMA and are shown to comply with the comment letter dated February 9, 2009. The cash compensation of Mr. Bracken, who serves as Chief Financial Officer of National Beverage Corp., is also paid entirely by CMA.CMA and is included under the “All Other Compensation” caption in the Summary Compensation Table. (See “Certain Relationships and Related Party Transactions.”Transactions”.)

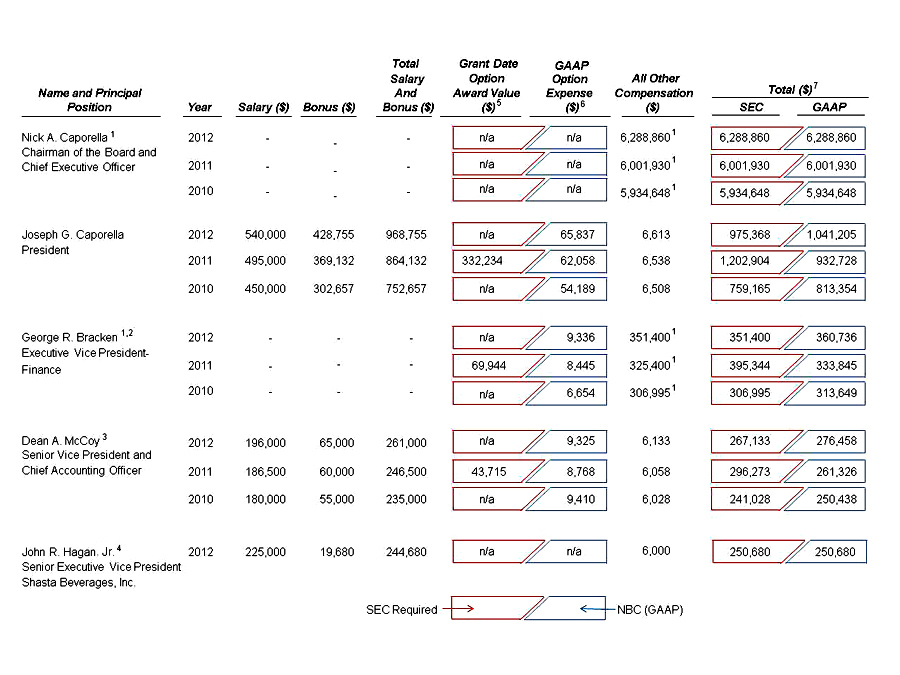

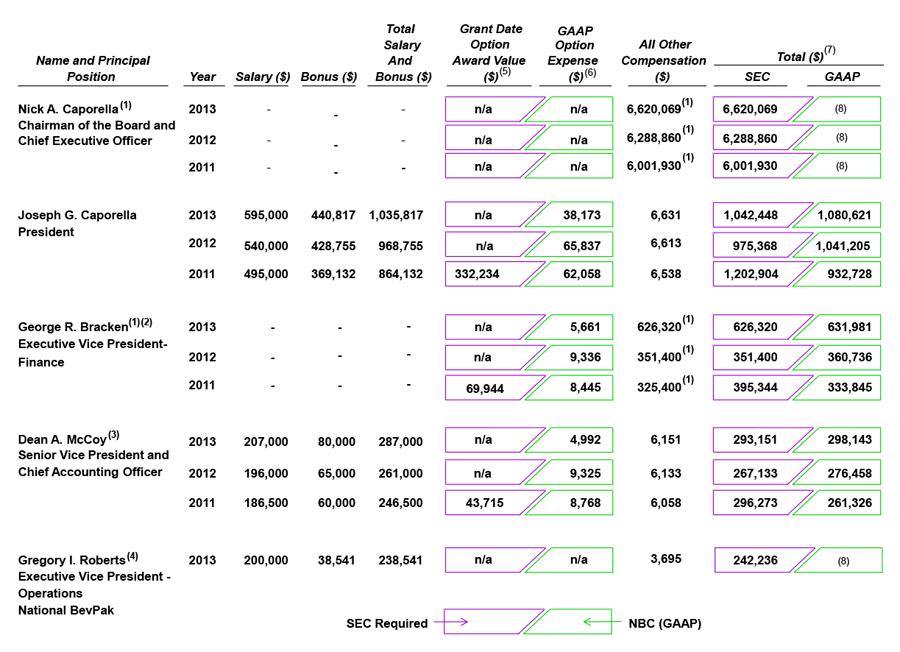

The following table sets forth information concerning compensation awarded to, earned by or paid to our Executive Offices,Officers, and payments made to CMA, for services rendered during the past three years:

Value ($) All Other Compensation ($) Total ($) SEC Nick A. Caporella 2013 - n/a 6,620,069 6,620,069 Chairman of Contents

1 | Mr. Nick A. Caporella, our Chairman of the Board and Chief Executive Officer, and Mr. George R. Bracken, our Executive Vice President – Finance, do not receive any cash compensation from the Company as their services are provided to us through CMA. As described above in “Compensation Discussion and Analysis” and “Management Services Agreement – Compensation” and below in “Certain Relationships and Related Party Transactions”, we pay an annual base management fee equal to one percent of our consolidated net sales for the services that CMA provides to us, which include, among other things, the services of Mr. Nick A. Caporella and Mr. Bracken, as well as |

2 | Mr. Bracken, who is 68 years old, was named Executive Vice President – Finance in July 2012. Previously, he served as Senior Vice President – Finance from October 2000 to July 2012 and Vice President and Treasurer from October 1996 to October 2000. |

| 3 | Mr. McCoy, who is |

4 | Mr. |

5 | As prescribed by SEC regulations, amounts represent the grant date fair value for Special Option awards granted on July 28, 2010 computed in accordance with Accounting Standards Codification 718 based on the Black-Scholes option pricing model. (See Note 9 to the Financial Statements included in the Company’s Annual Report on Form 10-K for additional information regarding the assumptions utilized.) Special Options generally vest over five to |

6 | Amounts represent the compensation expense recognized for stock option awards computed in accordance with Accounting Standards Codification 718 based on the Black-Scholes option pricing model. (See Note 9 to the Financial Statements included in the Company’s Annual Report on Form 10-K for additional information regarding the assumptions utilized.) Special and KEEP Options held by our Executive Officers generally vest over five to nine year periods and are expensed in accordance with GAAP. The Company believes that the annual compensation expense provides a more meaningful measure of the value of these options for any given fiscal year than the grant date fair value amount prescribed by SEC regulations and therefore, has been included as supplementary information. |

7 | The Company’s Board and management believe that |

| 8 | Neither Mr. Nick A. Caporella nor Mr. Roberts has been awarded stock options, therefore their totals |

GRANTS OF PLAN-BASEDPLAN-BASED AWARDS IN FISCAL 20122013

The following table sets forth information concerning equity or non-equity incentive plan basedplan-based awards granted to Executive Officers during Fiscal 2012.

Name | Grant Date | All Other Stock Awards: Number of Shares of Stock (#) | Grant Date Fair Value of Stock Awards ($) |

George R. Bracken | 12/28/12 | 15,278 | 220,9201 |

1 | Represents special unrestricted stock award granted to Mr. Bracken by the Board in recognition of his 20-plus years of service. The value realized was calculated by taking the fair market value per share of the Common Stock on the grant date, multiplied by the number of shares acquired. |

The following table sets forth information about the number of outstanding equity awards held by our Executive Officers at April 28, 2012.27, 2013. No equity awards have been granted to Nick A. Caporella since the inception of the Company.

Option Awards Name Number of Securities Underlying Unexercised Options (# Exercisable) Number of Securities Underlying Unexercised Options (# Unexercisable) Option Exercise Price ($) Option Expiration Date Joseph G. Caporella 39,192 02/12/16 07/23/17 George R. Bracken 02/12/16 07/27/20 Dean A. McCoy 02/12/16 07/27/20 2,808 2.671 11,872 26,128 8.081 07/27/20 880 1,320 0.012 4,800 — 2.101 2,240 5,760 8.391 2,577 1,023 4.231 1,400 3,600 8.391

1 | ||||||

| ||||||

| Options granted under the Company’s Special Option Plan are exercisable for a |

2 | Under the Company’s KEEP Program, participants receive a grant equal to 50% of the number of shares of the Company’s Common Stock purchased on the open market. KEEP options are granted at an initial exercise price of 60% of the purchased price of the shares acquired, and such price is reduced to the par value of the Common Stock over a |

The following table sets forth all stock options exercised and the value realized upon exercise by the Executive Officers during Fiscal 2012.2013. There are no stock awards outstanding.

Name | Number of Shares Acquired on Exercise (#) | Value Realized Exercise ($) | ||

Joseph G. Caporella | 5,400 |

|

1 | The value realized on exercise was calculated by taking the difference between the fair market value per share on the date of exercise less the option price, multiplied by the number of shares acquired. |

The following table sets forth information about shares of Common Stock that may be issued upon exercise of options and other stock basedstock-based awards under all of the Company’s equity compensation plans as of April 28, 2012.

| Plan Category | Number of Securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights ($) | Number of Securities remaining available for future issuance under equity compensation plans (excluding securities reflected in first column) | |||||

Equity compensation plans approved by shareholders | 488,040 | 7.50 | 2,853,693 | |||||

Equity compensation plans not approved by Shareholders1 | 24,580 | 1.89 | 127,172 | |||||

| Total | 512,620 | 7.23 | 2,980,865 | |||||

Plan Category Number of Securities to be issued upon exercise of outstanding options, warrants and rights Weighted average exercise price of outstanding options, warrants and rights ($) Number of Securities remaining available for future issuance under equity compensation plans (excludingsecurities reflected in first column) Equity compensation plansapproved by shareholders Equity compensation plansnot approved by shareholders1 Total 428,610 6.96 2,881,223 13,200 3.60 125,412 441,810 6.86 3,006,635

1 | Includes shares issuable for outstanding options and shares available for grant under the Company’s KEEP Program. |

Officers of the Company who are also directors do not receive any fee or remuneration for services as members of the Board of Directors or of any Committee of the Board of Directors. Effective January 2012, non-managementNon-management directors receivedreceive a retainer fee of $32,000 per annum, a fee of $1,500 for each Board meeting attended, a fee of $1,200 for each Audit Committee meeting attended ($2,500 in the case of the Chairman) and a fee of $800$900 ($1,500 in the case of a committee Chairman) for each other committee meeting attended. Set forth below are the amounts paid to non-management directors in Fiscal 2012.

Name | Fees Earned or Paid in Cash ($) | Option Awards($)1 | All Other Compensation ($) | Total ($) |

| Cecil D. Conlee | 44,500 | 24,490 | — | 68,990 |

| Samuel C. Hathorn, Jr. | 47,200 | — | — | 47,200 |

| Joseph P. Klock, Jr. | 40,800 | — | — | 40,800 |

| Stanley M. Sheridan | 40,800 | — | — | 40,800 |

Name Fees Earned or Paid in Cash ($) Option Award ($)1 All Other Compensation ($) Total ($) Cecil D. Conlee 62,500 — — 62,500 Samuel C. Hathorn, Jr. 70,100 — — 70,100 Joseph P. Klock, Jr.2 13,400 — — 13,400 Stanley M. Sheridan 58,600 17,512 — 76,112

1 | As prescribed by SEC regulations, amount represents the aggregate grant date fair value for a KEEP option grant awarded on |

2 | Mr. Klock resigned on October 5, 2012. |

COMPENSATION COMCOMMITTEEMITTEE INTERLOCKS AND INSIDER PARTICIPATION

REPORT OF THE AUDIT COMMITTEECOMMITTEE

The Audit Committee of the Board of Directors has furnished the following report:

Pursuant to its charter, the Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. The Company’s management has the primary responsibility for the financial statements and reporting process, including the Company’s internal control systems. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements included in the Annual Report on Form 10-K for the fiscal year ended April 28, 2012.27, 2013. This review included a discussion of the quality and the acceptability of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee discussed with the Company’s independent accountants,auditors, who are responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles, all matters required to be discussed by Statement on Auditing Standards No. 61.61, as amended. In addition, our independent accountantsauditors provided the Committee with the written disclosures required by the applicable requirements of the Public Company Accounting Oversight Board relating to the independent accountant’sauditor’s communications with the Committee concerning independence.

The Audit Committee discussed with the independent accountantsauditors the overall plans for their audits, the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended April 28, 201227, 2013 for filing with the Commission.

THE AUDIT COMMITTEE

Samuel C. Hathorn, Jr. (Chairman)

Stanley M. Sheridan (Deputy Chairman)

Cecil D. Conlee

The Company’s financial statements for Fiscal 20122013 and the year ended April 30, 201128, 2012 (“Fiscal 2011”2012”) were examined by McGladrey LLP (“McGladrey”), independent registered public accountants. Representatives of McGladrey are expected to be present at the Meeting to make a statement if they so desire and they are expected to be available to respond to appropriate questions.

Audit and Other Fees

For professional services rendered for the annual audit of the Company’s consolidated financial statements and internal controls, review of its interim financial statements included in the Company’s Form 10-Q and services that are normally provided in connection with statutory and regulatory filings, the Company was billed $426,000 for Fiscal 2013 and $465,000 for Fiscal 2012 and $454,000 for Fiscal 2011.2012. Included in such amounts are fees associated with Sarbanes-Oxley Section 404 requirements of $210,000 for Fiscal 2013 and $244,000 for Fiscal 2012 and $240,000 for Fiscal 2011.

During Fiscal 20122013 and 2011,2012, McGladrey did not bill the Company for any tax consulting or other products or services. The Audit Committee pre-approves all audit and permitted non-audit fees before such service is rendered.

The Company is a party to a management agreement with Corporate Management Advisors, Inc. (“CMA”), a corporation owned by our Chairman and Chief Executive Officer. This agreement was originated in 1991 for the efficient use of management of two public companies at the time. In 1994, one of those public entities, through a merger, no longer was managed in this manner.

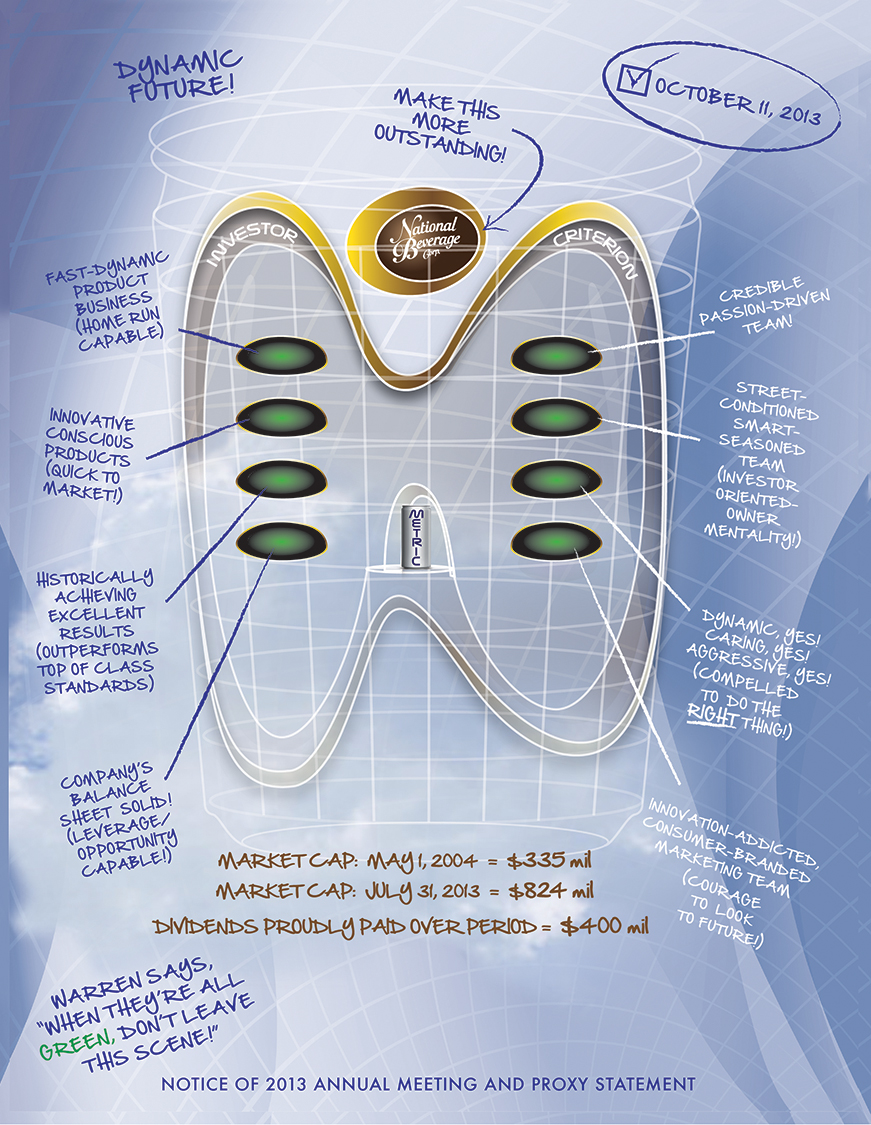

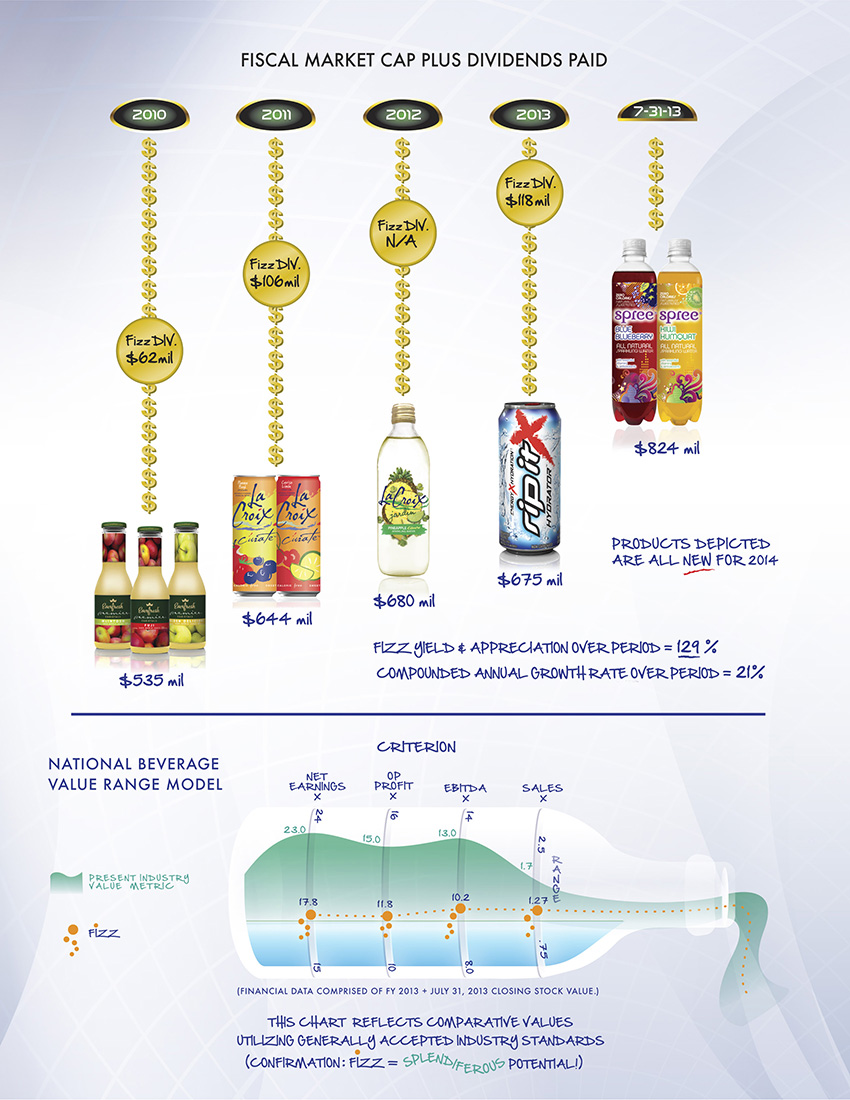

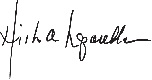

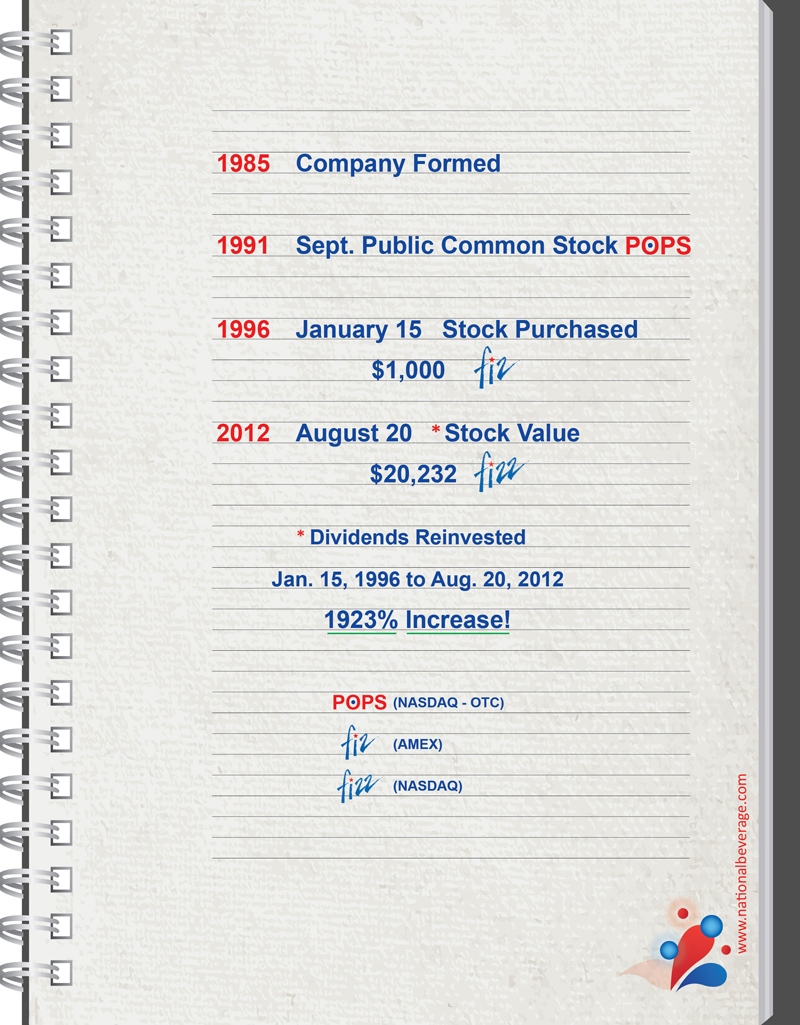

Under the terms of the agreement, CMA provides, subject to the direction and supervision of the Board of Directors of the Company, (i) senior corporate functions (including supervision of the Company’s financial, legal, executive recruitment, internal audit and management information systems departments) as well as the services of a Chief Executive Officer and Chief Financial Officer, and (ii) services in connection with acquisitions, dispositions and financings by the Company, including identifying and profiling acquisition candidates, negotiating and structuring potential transactions and arranging financing for any such transaction. CMA, through its personnel, also provides, to the extent possible, the stimulus and creativity to develop an innovative and dynamic persona for the Company, its products and corporate image. In order to fulfill its obligations under the management agreement, CMA employs numerous individuals, whom, acting as a unit, provide management, administrative and creative functions for the Company. In connection with providing services under the management agreement, CMA is a twenty percent (20%) joint owner of an aircraft used by the Company. The management agreement provides that the Company will pay CMA an annual base fee equal to one percent of the consolidated net sales of the Company, and further provides that the Compensation and Stock Option Committee and the Board of Directors may from time to time award additional incentive compensation to CMA. While our sales fromThe Board of Directors on numerous occasions contemplated incentive compensation and, while shareholder value has increased over 2,000% since the inception of this agreement, have increased significantly and enterprise value has increased 896%, no incentive compensation has been paid. We incurred management fees to CMA of $6.6 million for Fiscal 2013, $6.3 million for Fiscal 2012 and $6.0 million for Fiscal 2011 and $5.9 million for Fiscal 2010.2011. The Company does not have written policies and procedures with respect to related party transactions, but the Company’s practice has been that the services and performance of CMA which are the only related party transactions, are reviewed annually by the independent members of theCompensation and Stock Option Committee and theBoard of Directors.During the course of such reviews, the independent directors on the Compensation and Stock Option Committee have, on numerous occasions, proposed that CMA be paid an incentive due to superior performance based on various criteria, including the favorable outcome of specific negotiations and the performance of the Company’s Common Stock. However, no incentive compensation has been accepted by CMA and, as noted above, none has been paid since the inception of the management agreement.

On January 25, 2013, the Company sold 400,000 shares of Special Series D Preferred Stock (the “Series D Preferred”), par value $1.00 per share, for an aggregate amount of $20 million to 8100 Partners, LLC, a Florida limited liability company (the “LLC”). Members of the LLC include George R. Bracken, the Company’s Chief Financial Officer, other members of management and a trust previously established by Mr. Nick A. Caporella. The Series D Preferred will pay cumulative cash dividends in an amount equal to 3% per year on a quarterly basis until April 30, 2014, after which time the Series D Preferred will pay cumulative cash dividends in an amount equal to 370 basis points above the 3-Month LIBOR on a quarterly basis. The Series D Preferred is a non-voting class of stock and has a liquidation preference of $50 per share plus accrued but unpaid dividends. The terms of the Series D Preferred were reviewed and approved by a Special Committee which consisted of the independent members of the Board. After serious consideration of a more typical financial arrangement, the Board of Directors of the Company felt that the cost and expediency necessary to the performance of issuing this Series D Preferred found the terms so favorable over the conventional method that it was decided that this method benefitted the Company more favorably.

The accompanying proxy is solicited by and on behalf of the Board of Directors of the Company. Proxies may be solicited by personal interview, mail, email, telephone or facsimile. The Company will also request banks, brokers and other custodian nominees and fiduciaries to supply proxy material to the beneficial owners of the Company’s Common Stock of whom they have knowledge, and the Company will reimburse them for their expense in so doing. Certain directors, officers and other employees of the Company may solicit proxies without additional remuneration. The entire cost of the solicitation will be borne by the Company.

Shareholders who wish to communicate with the Board of Directors may do so by writing to Board of Directors, National Beverage Corp., P.O. Box 16720, Fort Lauderdale, Florida 33318. Such communications will be reviewed by the Secretary of the Company, who shall remove communications relating to solicitations, junk mail or other correspondence relating to customer service issues. All other communications shall be forwarded to the Board of Directors or specific members of the Board as appropriate or as requested in the shareholder communication.

Any proposal of a shareholder intended to be presented at the Company’s 20132014 Annual Meeting of Shareholders must be received by the Company for inclusion in the Proxy Statement and form of proxy for that meeting no later than May 7, 2013.9, 2014. Additionally, the Company must receive notice of any shareholder proposal to be submitted at the 20132014 Annual Meeting of Shareholders (but not required to be included in the Proxy Statement) by July 10, 2013,24, 2014, or such proposal will be considered untimely pursuant to Rule 14a-4 and 14a-5(e) underof the Exchange Act and the persons named in the proxies solicited by management may exercise discretionary voting authority with respect to such proposal.

Our Restated Certificate of Incorporation contains an advance notice provision relating to shareholder nominations of directors at any meeting of the shareholders called for the election of directors. Under the Company’s Restated Certificate of Incorporation, any nomination must (i) be received by our Secretary no earlier than 60 and no more than 90 days before the meeting by notice to the Secretary of the Company, provided, however, that if fewer than 70 days’ notice of the meeting is given to stockholders, such written notice shall be received no later than 5:00 pm on the 10th calendar day following the first day following the day on which notice of the meeting was first mailed to stockholders and (ii) include certain information relevant to the shareholder and their nominee.

The Board of Directors does not now intend to bring before the Meeting any matters other than those disclosed in the Notice of Annual Meeting of Shareholders, and it does not know of any business which persons other than the Board of Directors intend to present at the Meeting. Should any other matter requiring a vote of the shareholders arise, the accompanying proxy form confers upon the person or persons entitled to vote the shares represented by any such proxy discretionary authority to vote the same in respect of any such other matter in accordance with their best judgment.

Please date, sign and return the proxy at your earliest convenience in the accompanying pre-addressed envelope (no postage is required for mailing in the United States) or vote electronically using the Internet or by telephone. A prompt return of your vote will be appreciated as it will save the expense of further mailings.

By Order of the Board of Directors, | ||

| ||

| ||

Nick A. Caporella | ||

August 26, 2013 | Chairman of the Board | |

Fort Lauderdale, Florida | and Chief Executive Officer |

FOLD AND DETACH HERE FOLD AND DETACH HERE  |

Please mark you vote as Indicated in this example | x | ||||||

| 1. | Election of two Class I Directors for a term of three years. | 2. | In their discretion, upon any other matters which may properly come before the meeting or any adjournments or postponements thereof. | ||||

| NOMINEES: | |||||||

| FOR | WITHHOLD | This proxy when properly executed will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this proxy will be voted FOR the election as Class I Directors of the two nominees of the Board of Directors, and with discretionary authority on all matters which may properly come before the meeting or any adjournments or postponements thereof. | |||||

| 01 Joseph G. Caporella | o | o | |||||

| FOR | WITHHOLD | ||||||

| 02 Samuel C. Hathorn, Jr | o | o | |||||

| The undersigned acknowledges receipt of the accompanying Proxy Statement dated August 27, 2012. | |||||||

| Please mark here if you plan to attend the meeting | o | ||||||

Mark Here for Address Change or Comments SEE REVERSE | o | ||||||

FOLD AND DETACH HERE FOLD AND DETACH HERE  |